One of the most frequent questions that I hear from both my clients and my fellow travelers is, “What do you think of travel protection? Is it a waste of money?” And all too often I also hear, “We’ll take our chances – what can happen?” This blog would become a novel if I gave you the list of what HAS happened to my clients, and to me, in the past, but hopefully it gives you some tools for deciding if travel protection is a good choice for you!

First, the disclaimer. I am not, nor have I ever been, nor do I ever want to be a licensed insurance agent. (This is not an insult to insurance agents; I just don’t have their expertise!) I am not qualified to answer technical questions about the benefits, exclusions, and conditions of any offered insurance and I cannot evaluate the adequacy of anyone’s existing coverage.

DO always read the small print in your trip’s cancellation policy. And while you may not feel it is worth insuring for cancellation alone, there are other factors to consider when deciding on travel protection. Your last minute $800.00 Caribbean cruise can turn into something much more expensive should you become ill while traveling.

There is always a bit of confusion on what is and isn’t covered by your personal health insurance, your credit card, or other memberships to which you may belong. Your credit card, for example, may cover medical expenses while you are away, but what constitutes “away?” Are you covered internationally? More importantly, are you covered for medical evacuation from a ship or foreign country? What are the terms and conditions of coverage? DO your research before you assume that you already have coverage.

DON’T assume that because you are young or in good health that you don’t need coverage. Accidents happen, illness can strike unexpectedly, and even a minor illness can prevent you from traveling or have you seek medical assistance mid-trip. Your 4-year-old can wake up the morning of your flight to Walt Disney World with a double ear infection. An elderly parent may slip and fall and need your assistance at home. (Yes, that’s covered.) A family member may need medical evacuation from a ship when appendicitis is diagnosed. All of these incidences are rare, but DO know that these and more have happened to my clients in the past.

DO be aware that medical evacuation can cost upwards of $25,000.00. Ouch.

DO know that every travel provider has different policies on pre-existing conditions. For most, the travel protection must be purchased within 14 days of the initial trip deposit in order for the pre-existing condition waiver to be added. For most cruise lines, this does not mean simply adding it to the reservation; it must be added and PAID for. For some cruise lines, Disney Cruise Line in particular, there is no way to add and pay for the travel protection ahead of time, so there is no pre-existing condition coverage. DO contact the insurance provider directly for details! (See disclaimer above.)

DON’T forget those family members who you leave behind. Should you need to cancel for an immediate family member not traveling with you, their pre-existing conditions are also taken into consideration.

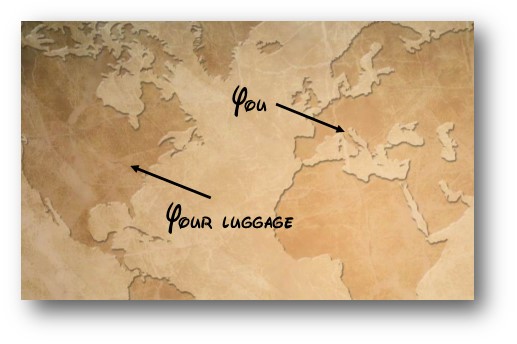

DO note that small blips in a trip can result in big expenses. On a recent trip to Rome to board a cruise ship, my luggage had other ideas. After it traveled from Boston to Paris to Rome to Messina to Malta, I was finally reunited with my belongings. Not only did the insurance provider help track the adventures of my possessions, but they sent me a check within two weeks for everything I had to buy in Rome.

Although nothing to do with insurance, DO know that shopping for clothes in Rome, when you are woman of almost six feet tall, is a challenge. (Shopkeeper: For you. Ahhh… noooooo… “)

And DON’T overlook the rest of what many travel protection plans can offer! Your flight is delayed and you need a room at an airport hotel? Check. Missed connection? Assuming it’s the airline’s or nature’s fault and not because you were watching Friends reruns at the airport bar – check. Your luggage arrives home in more pieces than it was when checked in, and is now wrapped up in duct tape? Check!

DO always discuss travel protection options with your Magic for Less Travel consultant (knowing that they have the same disclaimer as mentioned above).

While this blog risks the chance of muddying the travel protection waters even more (not covered!), hopefully it provides a little insight into whether it’s the right choice for you!